Case Study

To provide accurate forecasting, full audit and statutory returns support whilst increasing yield from commercial property.

Wilks Head & Eve applied processes designed to analyse and assess the Rating List then identify missing properties. An exemplar case concerned an identified property consisting of a 2425m² warehouse, together with 2642m² of hard surfaces, fenced land and 58 car parking spaces.

The unrivalled expertise of Wilks Head & Eve resulted in an inspection that collected all the required evidence to secure and submit a fully e-BAR compliant report to the Valuation Office. The hereditament was brought into the list immediately and with a rateable value of £122,000, an annual yield of more than £60,000 was achieved, backdated by 2 years in accordance with legislation.

Case Study

To identify undervalued premises with the objective of increasing the Rateable Value.

Wilks Head & Eve used its unique process to identify a retail property that appeared undervalued due to the later addition of a mezzanine floor. After collection and analysis of all the necessary evidence the client was provided with an e-bar compliant report.

Using Wilks Head and Eves proven combination of processes and valuation expertise, this inspection was able to pinpoint 600m2 of additional retail floor space which would have been difficult to identify using tradition means. The client was able to benefit from a back dated yield of £27,000 along with an increase of 60% on yield year on year.

To find out more about how Wilks Head & Eve can help your revenues assurance needs, please contact us using the form.

Case Study

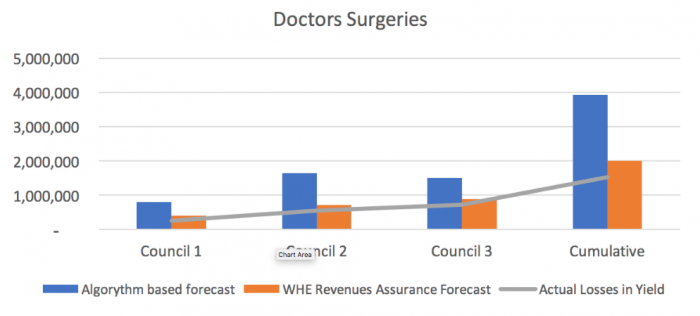

In 2015, the Upper Tribunal (Lands Chamber) determined that the valuation method for purpose-built doctors’ surgeries should be valued using the contractor’s basis, as opposed to using rental evidence (Gallagher (VO) v Dr M Read & Partners and Dr J Poyser and Partners (2015 UKUT 00001 LC)). At the hearing, it was accepted that this was a ‘test case’ that would impact upon 1,600 similar properties nationally. This meant that there was an increased risk of losses in yield for all local authorities, the question was: By how much? There were two approaches to forecasting the losses:

Using an algorithm to calculate the likely reduction overall and applying it to each local list.

Examining the valuations and identifying the properties likely to reduce in value.

The outcomes were stark in demonstrating the accuracy of our methodology:

This demonstrates that WHE Revenues Assurance forecasting was over 120% more accurate than our competitors and even with the appropriate level of prudence, our method enabled just three of our clients to reduce their provisions by almost £2 million.

Valuation for rating purposes has evolved over many years and continues to be refined Understanding which businesses are exempt from business rates through case law requires significant rating valuation knowledge and experience. Only Wilks Head and Eve have the breadth of knowledge and experience to accurately forecast the impacts for our clients.