Following the presentation I delivered at the IRRV National Annual Conference, I wanted to reiterate five key challenges that business rates teams are most likely to face in the year ahead.

Following the presentation I delivered at the IRRV National Annual Conference, I wanted to reiterate five key challenges that business rates teams are most likely to face in the year ahead.

Rates Retention Reform

On the 3rd October this year, the local government finance settlement 2020-21 proposals were unveiled. These revealed that the business rates retention pilots agreed for 2019 to 2020 will finish at financial year end (all but non-devo), with no further plans to run pilots in 2020 to 2021. There was also confirmation of a delay in the funding distribution and business rates retention reforms until 2021 to 2022 and there will be a full reset of business rates retention baselines.

Even if the mechanisms for rates retention change, it won’t remove the need for business rates teams to make provisions for losses on appeal. As I alluded to in my recent Insight article the consultation also focussed on redefining ‘losses on appeal’ into one of two categories ‘valuation changes’ and ‘physical changes’. In my experience with most changes typically relating to ‘physical changes’ and the value of these changes in many instances being extremely high, local authorities need to keep the correct level of expertise to address this going forward.

Challenges and Appeals

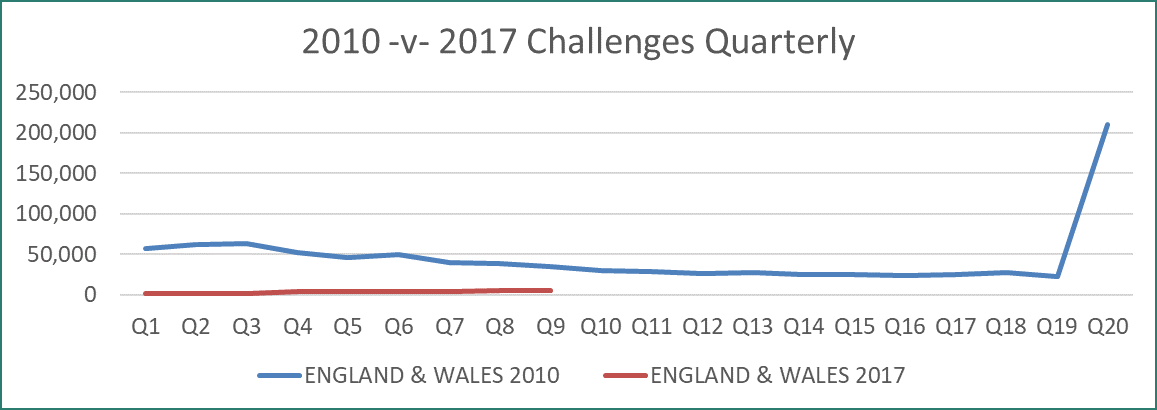

For those that missed my presentation on the day, I presented the graphic below which charted the quarterly challenges of the 2010 Rating List versus where we currently are with challenges on the 2017 Rating List.

As you can see there are nowhere near as many challenges being lodged at this point in time when compared with the 2010 Rating List. There is a general view that many ratepayers and agents are delaying lodging challenges due to the complexity of the new process. Most experts are predicting that these delays will end soon and the number of challenges will increase significantly. In other words, the new system has caused a different profile as opposed to a reduction and over the second half of the list period, we will see challenges increase significantly.

If we look historically, we see a massive leap in challenges in the final few quarters of the 2010 list with over 200,000 challenges made (representing just over 20% of all challenges) and some expect this pattern to repeat with the 2017 list. Going into 2020 business rates teams need to be prepared to deal with a potential increase in challenges and the additional workload this will bring as well as the inevitable increase in risk of losses to local government.

Business Rates Avoidance

In the last couple of years there has been a significant increase in instances of business rates avoidance including special purpose vehicle companies (SPV’s), guardian schemes and temporary occupation. Similarly there has been exploitation of relief schemes with mandatory rates relief given to ‘supposed’ charitable occupations and small business rates relief awarded where hereditaments have been split and occupied by separate companies.

The biggest issue facing business rates teams here is that rates avoidance is now an established practice with companies set up with the sole purpose of helping clients avoid paying rates. Furthermore most have now run their course through the higher courts and rather frustratingly if done correctly are deemed to be legal.

Business rates teams need to keep up to date on the latest avoidance schemes and ensure they carry out due diligence to make sure that avoiders are doing everything they say they are doing that qualifies them for exemption of paying rates in the first instance.

Relief & Exemptions

In the last five years local government has been required to deal with a large number of new reliefs and exemptions pushed through, with the most recent being the public convenience bill, the retail relief for RV’s below £51K and an extension of the local newspaper relief. These reliefs tend to be either politically inspired or a reaction to a changing environmental or financial situation.

The 1988 Local Government Finance Act outlines the circumstances for reliefs and exemptions. This is over 30 years old and what might have been appropriate then, may no longer be the case now. The use of discretionary reliefs to deal with modern day issues has become custom and practice. Put Brexit into the mix and depending on the type of Brexit we have we may see some further concessions and a review of existing reliefs. Business rates team need to remain agile and have a system in place that helps them easily roll out and support government mandated reliefs in a post Brexit era.

Business Rates Collection

Finally business rates teams need to consider changes to collection practices with the roll out of the Breathing Space scheme in 2020 giving those in debt the right to protect themselves from creditor action for up to 60 days. This will give debtors time to receive appropriate debt advice and come up with an appropriate debt repayment plan which could span between 7 to 10 years.

As well as individuals, this scheme covers the business debt of sole traders and will include business rates debt. Depending on where the line is drawn on what is considered breathing space or not, Councils may need to split liabilities, so some of a debt may need to be put on hold, whilst another part of it can be actioned.

We can’t yet fully predict the outcome of this new scheme and its impact on collections however if it has a larger than anticipated impact, there may need to be investment in software and case management systems to analyse, manage and report on the outcomes of cases.

You can download a copy of the presentation here > If you want to discuss any of the issues raised in this article in more detail contact our ratings specialists on 020 7637 8471 or email atownsend@wilks-head.co.uk