With local government facing ever dwindling budgets, there is a need to become more resourceful when it comes to generating income. Following roll out of the rates retention scheme in 2013-14 we thought that Local Authorities would be increasingly turning to areas like business rates to maximise income. However our latest survey results suggest that not as many Authorities are doing this as we initially believed and this appears to be primarily down to resourcing issues.

In order to get a better understanding of what Councils are doing to maximise rating collections, the Wilks Head & Eve team ran a survey last month, gaining insight from eighteen Local Authorities.

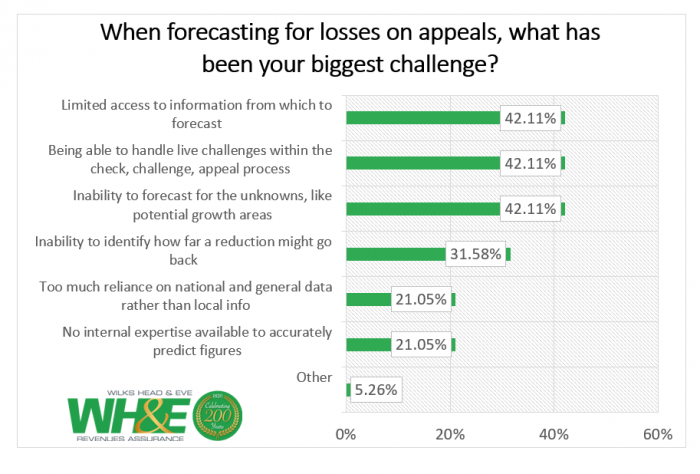

Challenges when forecasting for losses on appeal

When asked whether they used external assistance to forecast for losses on appeals 52% of Councils said they did not use external suppliers despite the complexities and variables involved in this process. Furthermore when asked about the challenges they faced when forecasting for losses on appeals, 3 distinct areas came out on top; ‘an inability to forecast for the unknowns’, ‘the ability to handle live challenges within the CCA process’ and lastly ‘not having access to all the relevant data from which to forecast’.

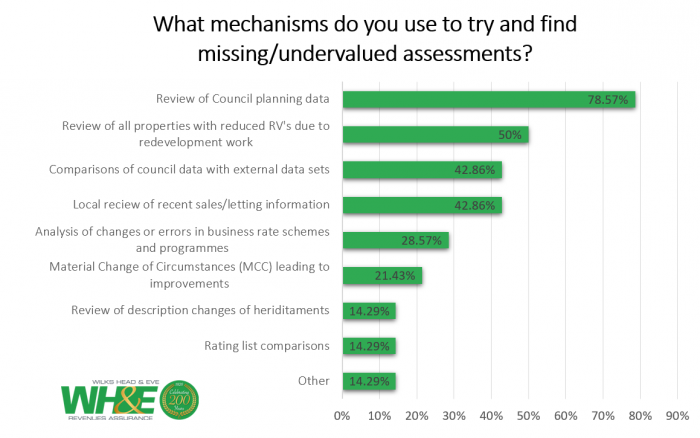

Active engagement in identifying missing assessments

The survey then went on to ask whether Councils actively engaged in identifying missing or undervalued assessments on the rating list as a means to boost their annual revenue collections, with 63% confirming that they did. For the remaining 37% that did not, the main reason identified was down to resourcing issues with 85% of them unable to provide the appropriate resources to get the job done.

For those that do try to find missing and undervalued assessments we asked what mechanisms were predominantly used. Rather unsurprisingly ‘reviews of council planning data’ came out top at 78%, this is typically the first port of call for most Local Authorities, who can quite easily use planning information to identify new commercial developments. This was followed by ‘reviews of all properties with reduced rateable values due to redevelopment work’ coming in second at 50%.

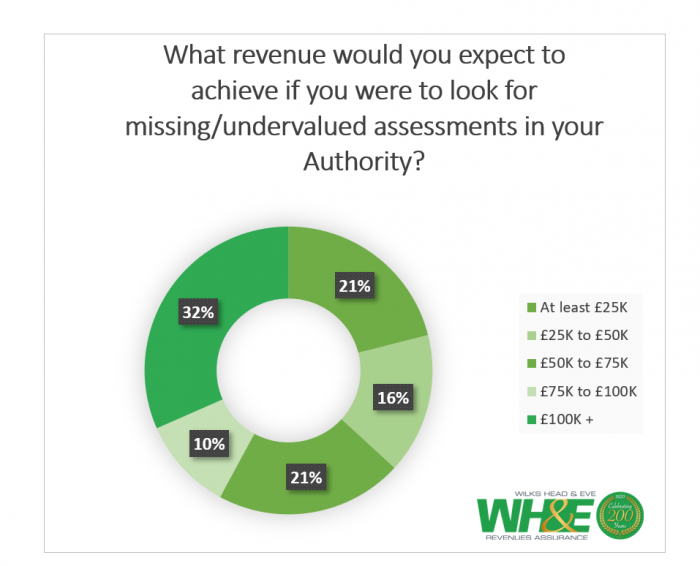

When asked what level of additional revenue their Authority would expect to see if and when they did look for missing or undervalued assessments ‘£100K+’ came in top, this was the highest range respondents could have selected with just under a third of Councils expecting to receive this type of return.

Lastly we wanted to gain some insights into what Local Authorities would look for from a valuation and ratings maximisation partner that could carry out these types of activities on their behalf. Far and away the most popular characteristic was ‘sector knowledge and expertise – professional advice from qualified valuation experts’ at 89% followed next by ‘value for money’ at 78% and thirdly ‘accuracy – achieving best possible forecasts for losses on appeals’ at 52%.

Roger Messenger, Partner from Wilks Head & Eve comments “it’s clear from the survey results, albeit a fairly small sample, that there are still some Authorities out there either going it alone or who are simply unable to allocate the time and resource required to identify missing or undervalued assessments. Wilks Head & Eve work with countless Authorities to manage this entire process on their behalf so that resourcing is no longer an issue.”

If you want to find out more about the services offered by Wilks Head & Eve contact rmessenger@wilks-head.co.uk or call 0207 907 7897 to discuss further.